The bitcoin price has jumped above $7,500 to discover its fresh yearly high.

The world’s largest cryptocurrency established $7,568.32 as its new session peak, bringing its year-to-date net rebound up to 140 percent on San Francisco-based Coinbase exchange. The broader cryptocurrency market tailed bitcoin’s uptrend, with a majority of top assets posting double-digit gains, including Bitcoin Cash, Litecoin, EOS, and Ethereum. Even Bitcoin SV, which lately faced trading ban at several cryptocurrency exchanges, saw a 10 percent appreciation in the last 24 hours.

What’s Driving Bitcoin Bulls

Bitcoin’s continuous climb to $7,500 came in the wake of improving buying sentiment and technical forecasts. Fidelity Investments, a Boston-based asset management firm with a vast Wall Street clientele, announced last week that it would add bitcoin trading to its list of institutional investment services. At the same time, online investment service TD Ameritrade started offering stimulated bitcoin trading through Nasdaq, raising hopes that a full-fledged bitcoin adoption was underway.

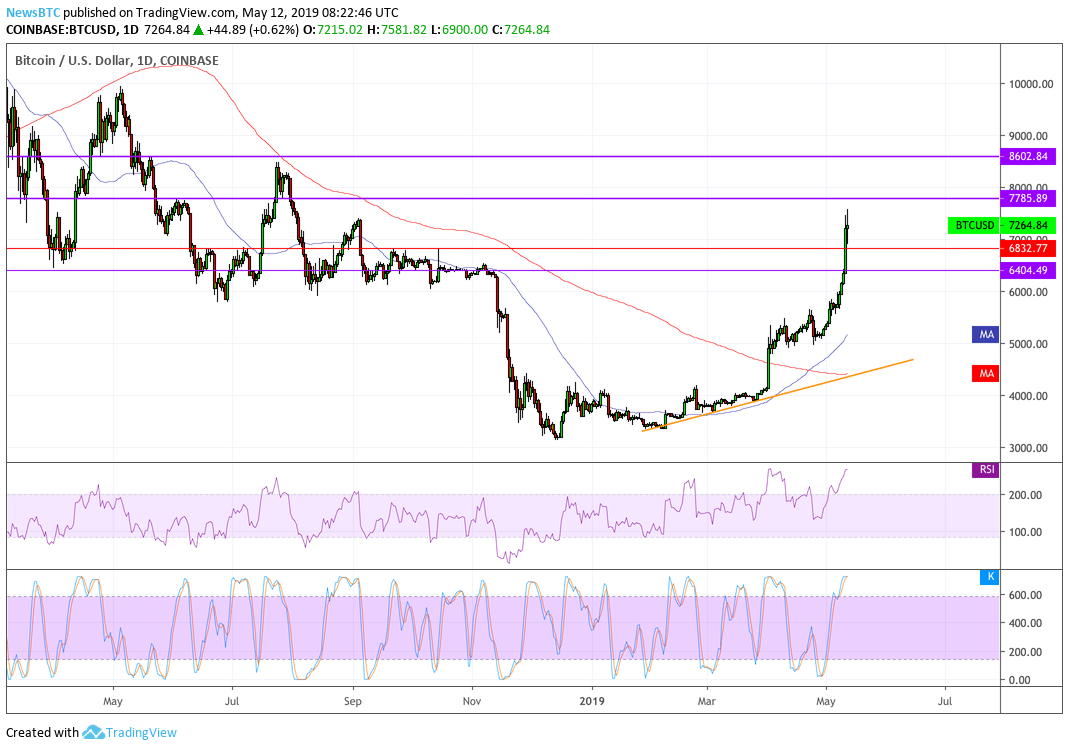

Meanwhile, technical data continued to identify the end of bitcoin’s most prolonged bearish phases after the asset formed a low in $3,100-3,200 range on December 15, 2018. Momentum indicator Stochastic RSI, for instance, rebounded from its oversold territory for the first time since February 2018 on monthly charts. The move identified a trend shift, meaning that the market was eyeing an extended bitcoin price recovery in the future.

$BTC Stoch RSI currently at 2015 pre bull run level (33) and should enter

"overbought" territory in about 1 or 2 months.Last time it lasted 2 years from $300 to $19K. #bitcoin pic.twitter.com/mhezb6YL85

— Galaxy (@galaxyBTC) May 10, 2019

At the same time, bullish analysts continued to strengthen their long-term upside targets following the Golden Cross formation. The technical chart pattern held a historical significance in the bitcoin market for shooting the price from $300 to $20,000 in 14 months. The latest Golden Cross formation too prompted a bitcoin uptrend which, as bulls believed, would lead the price beyond $20,000 by the end of this year.

A significant investment firm was also studying bitcoin’s old price behavior to understand its next move. Vancouver-based Canaccord Genuity found that bitcoin could continue its bull trend over the next 24 months. The firm expected the cryptocurrency to retest $20,000 due to next year’s Halving event, which would reduce the current bitcoin supply by half.

“Now four months into 2019, we note for the third time the striking similarity in bitcoin’s price action between 2011-2015 and 2015-2019,” Canaccord said in a note. “While this simple pattern recognition has a little fundamental basis, we note that bitcoin does operate on a four-year cycle of sorts, as the halving of bitcoin’s mining reward occurs approximately every four years.”

Near Term Targets

The bitcoin price was now eyeing the $7,785-8,602 range as its next potential bull target. The said area had adequate reversal sentiment, given its ability to cap small uptrends between April and July 2018. A pullback at any given level could push the bitcoin price violently towards interim supports, the nearest one being at $7,000.

The post Bitcoin Price Crosses $7,500 to Establish Fresh 2019 High appeared first on NewsBTC.

No comments: